What is a Common Size Income Statement? Definition Meaning Example

Category : Bookkeeping

Content

Here, you’ll render items on your cash flow statement as a percentage of net revenue. This analysis lets you see how effectively you’re leveraging the cash in your business, beyond just dollars flowing into and out of your bank account. By analyzing how a company’s financial results have changed over time, common size financial statements help investors spot trends that a standard financial statement may not uncover. The common size percentages help to highlight any consistency in the numbers over time–whether those trends are positive or negative. Common size balance sheets are similar to common size income statements. The only difference is that each line item on this accounting balance sheet is expressed as a percentage of total assets.

Any significant movements in the financials across several years can help investors decide whether to invest in the company. The same process would apply on the balance sheet but the base is total assets. The common-size percentages on the balance sheet explain how our assets are allocated OR how much of every dollar in assets we owe to others (liabilities) and to owners (equity). Many computerized accounting systems automatically calculate common-size percentages on financial statements. Since we use net sales as the base on the income statement, it tells us how every dollar of net sales is spent by the company. For Synotech, Inc., approximately 51 cents of every sales dollar is used by cost of goods sold and 49 cents of every sales dollar is left in gross profit to cover remaining expenses.

How to Analyze Common Size Income Statement

Ultimately, positive cash flow from financing activities left the business with a positive cash position of $13,000. In the future, the company can improve by decreasing investment expenditures and increasing revenue from operating activities. A single-step income statement, on the other hand, is a little more straightforward. It adds up your total revenue then subtracts your total expenses to get your net income.

EBITDA went from 32% to 49% of revenues, and EBIT went from 28% to 46% of revenues. The year brought double-digit changes to several line items on the income statement. These must be researched further to ascertain the results are meaningful for decision-making sample income statement purposes rather than the result of one-time events that will not be replicated. A common-size income statement is an income statement in which each line item of a traditional income statement is expressed as a percentage of total sales or revenue.

What Is a Common Size Income Statement? Definition and Examples

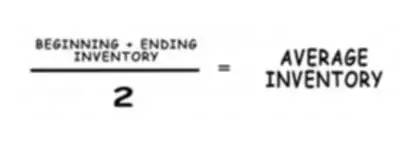

Now, dig deeper into why the company’s margins increased, decreased or remained consistent by looking at the items above the margins. Common size simply is when you take each line on the income statement and divide it by the revenue in the same period. When comparing any two common size ratios, it is important to make sure that they are computed by using the same base figure.

- The real value of a common-size income statement comes when you can compare it to other income statements.

- You’re an expert at running your business, not analyzing financial numbers.

- It is not another type of income statement but is a tool used to analyze the income statement.

- A common size income statement is generally how horizontal analysis is done in most companies when they evaluate the business performance over multiple time periods.

- It really depends on the size of your company, the historical profitability, the financial analysis sophistication of your company, management capability, etc.

- Figure 13.8 “Comparison of Common-Size Gross Margin and Operating Income for ” compares common-size gross margin and operating income for Coca-Cola and PepsiCo.