What Are The Services Of Accounting Firms?

Category : Bookkeeping

Content

Accounting and bookkeeping services (as well as other service lines, such as simple tax preparations) are almost universally charged as a fixed fee, and there is a market expectation for that pricing structure. Luckily, accounting firms don’t need a physical space to operate successfully. And like the traditional brick and mortar approach, having a home-based or virtual business brings both opportunities and challenges that are unique to that approach. When considering a home-based business, it’s important to think about the unique challenges and opportunities involved. An accounting firm can do almost everything a CPA firm can do with one exception – audits and assurance services.

Our new firm name, Financial Solution Advisors, describes the scope of what we do to help our clients. Based in Jacksonville, our full-service accounting firm specializes in tax planning and preparation, outsourced accounting, CFO services, consulting, and financial planning services for businesses and individuals. Our promise is excellent service through our professional expertise, technological advantages, and dedication to every client’s specific needs. It makes sense, considering they know your business environment, your tax situation and your financial standing.

The transformation to advisory services: A few observat…

Some accounting firms provide business development and valuation services. The firm will look through the books, use historical data to determine growth patterns, and provide the required reports to financial firms. Some do a lot, and some focus on specific services because they have found a niche of expertise. You should investigate the services a firm provides to ensure they provide all you need. With value pricing, you look at your client’s situation first, determine what they need, come up with the price that you think you’ll pay per month, and then as the last step, you compare it to your own costs. You will notice services like tax preparation are simpler to define while advisory services leave more potential for gray areas.

- Many business owners are great at providing the product or service that is the backbone of the business.

- Another competitive edge gained by working with a full-service accounting firm is getting access to these specialties when you need them.

- The one big trick with fixed pricing and value pricing for a bookkeeping service is really all about defining your service offering in advance.

- Not every accounting firm offers every type of service, and business owners should interview various firms to determine which is the best fit for the company’s specific business needs.

- Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges they’re facing.

However, it takes this service one step further by summarizing and interpreting these records. Hence, the output of accounting service is more useful for business owners in decision-making. An outsourced Chief Financial Officer (CFO) is a good option for businesses who are finding success, experiencing rapid growth, resolving a challenge, or are in need of project-based expertise. An outsourced CFO is a financial advisor and strategic consultant that provides services to a company on a part-time or project-based level. When looking for an outsourced CFO, look for someone with the unique understanding of owning, growing, and operating a business. Since every business is different, a good accounting service offers different levels of service depending on their business needs.

How much should an accountant charge per hour? Or should accountants charge a fixed fee?

After defining your brand and creating your logo the next step is to create a website for your business. The most common business structure types are the sole proprietorship, partnership, limited liability company (LLC), and corporation. Competition among these firms intensified, and the Big Eight became the Big Six in 1989. In that year, Ernst & Whinney merged with Arthur Young to form Ernst & Young in June, and Deloitte, Haskins & Sells merged with Touche Ross to form Deloitte & Touche in August. In many cases, each member firm practices in a single country, and is structured to comply with the regulatory environment in that country. The handholding begins as soon as you sign up with Pilot and are immediately assigned a dedicated bookkeeper as your account manager.

- While the idea that “first impressions matter” may seem a little cliché, they still matter to your clients.

- Some may charge by the project, which is often the case when it comes to preparing taxes.

- It’s now the largest bookkeeping service, with in-house professionals doing the bookkeeping for more than 11,000 business owners, which is why we chose it as the best accounting firm for bookkeeping services.

- Get the app list, reasons why they rock and my top tips and tricks.Plus, you’ll get my weekly Top 5 email curating helpful, innovative content for your modern firm.

- However, while a strong work ethic, exceptional service, and competitive pricing will undoubtedly attract clients, a successful business always requires more than just good luck.

- Some of these accountants could be certified public accountants—CPAs—but not every accountant is a CPA.

However, there is a difference between a website presence and social media. In most cases, a website is static and allows businesses to transmit basic, evergreen law firm bookkeeping information such as phone number, services provided, and credentials. Social media, on the other hand, can drive business in a longer and more indirect fashion.

STEP 9: Create your business website

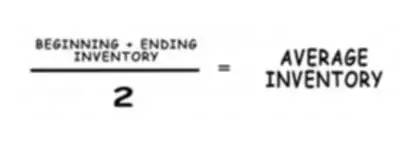

They are also often involved in budgeting for the release of your new products and preparing financial data for your investors and tax authorities. Furthermore, management accountants look at both past and present data in order to plan for the future of your business. If you already are using an accounting or bookkeeping software program, it would be ideal to work with a firm that utilizes the same software. If you don’t already use a software program, the accounting firm will recommend a package.